36+ massachusetts excise tax calculator

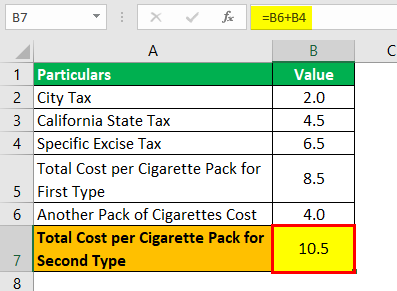

The current rate is. Web The Massachusetts excise tax on cigarettes is 351 per 20 cigarettes one of the highest cigarettes taxes in the country.

Car Tax By State Usa Manual Car Sales Tax Calculator

Web They apply when a homeowner sells real property for more than 100.

. Web Calculating Massachusetts Car Sales Tax. If your vehicle is. After a few seconds you will be provided with.

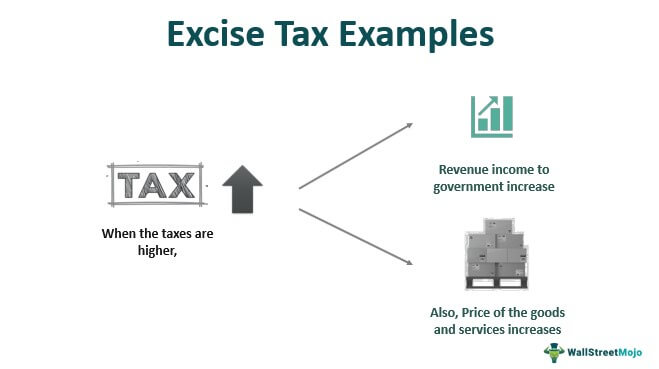

Avalara solutions can help you determine excise tax and sales tax with greater accuracy. The amount of the excise tax stamp differs from time to. Web The most significant taxes in Massachusetts are the sales and income taxes both of which consist of a flat rate paid by residents statewide.

These taxes are billed at the county level payable to the Registry of Deeds. Web State excise tax 25 for each 1000 of the cars value The vehicles value is a percentage of the manufacturers list price in the year it was manufactured. Web To use our Massachusetts Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Web The excise rate is 25 per 1000 of your vehicles value. Ad Avalara excise tax solutions take the headache out of rate determination and compliance. Web On TurboTaxs Website If you make 70000 a year living in Massachusetts you will be taxed 11448.

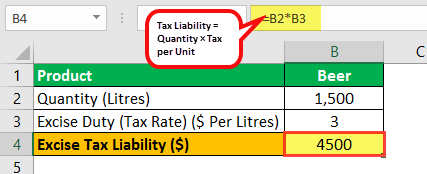

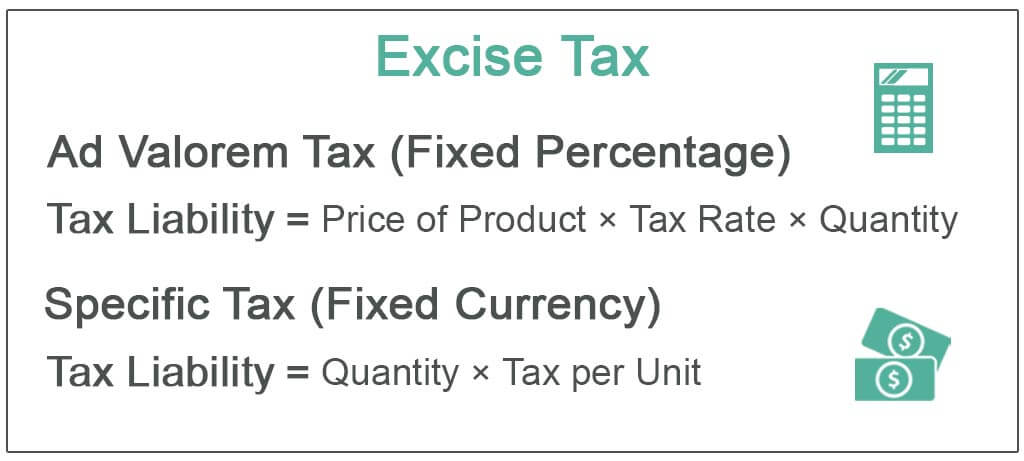

Web Excise Tax Calculator The effective tax rate is 228 per 500 or fraction thereof of taxable value. The excise due is calculated by. It is charged for a full calendar year and billed by the community where the vehicle is usually garaged.

There is no excise tax due where the consideration stated is less than 10000. To find out the value of. It is an assessment in lieu of a personal property tax.

Massachusetts excise tax on cigarettes is ranked 2. Web A vehicles excise valuation is based on the manufacturers list price MSRP in the vehicles year of manufacture. Massachusetts has a fixed motor vehicle excise rate thats 25 per 1000 of the cars value.

Your average tax rate is 1167 and your marginal tax rate is 22. Web Calculating Motor Vehicle Excise Taxes Motor vehicle excise is taxed on the calendar year. Various percentages of the manufacturers list price are.

Web The Commonwealth of Massachusetts derives revenue from the sale of real estate through the sale of state tax stamps.

Excise Tax Definition Types Calculation Examples

How Dependent Is The Alcohol Industry On Heavy Drinking In England Bhattacharya 2018 Addiction Wiley Online Library

Source Weekly March 11 2021 By The Source Weekly Issuu

Who Bears The Burden Of Federal Excise Taxes Tax Policy Center

Excise Tax Calculator Suffolk County Registry Of Deeds

Pdf Tires And Passenger Vehicle Fuel Economy Brigham Mccown Academia Edu

Excise Tax Examples What Is It Top 3 Practical Examples

Excise Tax Definition Types Calculation Examples

S 1 A

Why Isn T Enough Protest Arising From The Public Against Consistently Hiking Fuel Price In India Are They Exhausted And Resigned To The Fact Or Weak Opposition Failing To Raise It Which Would

Pdf An Assessment Of Tax Compliance Level Of Small Enterprises In Ghana Lawrence Asamoah Academia Edu

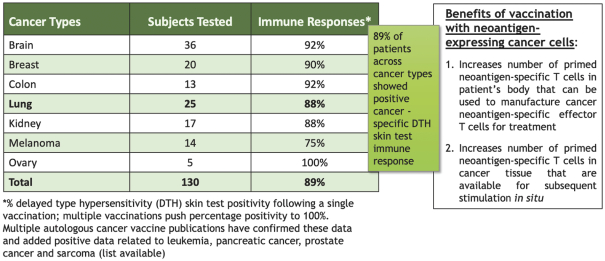

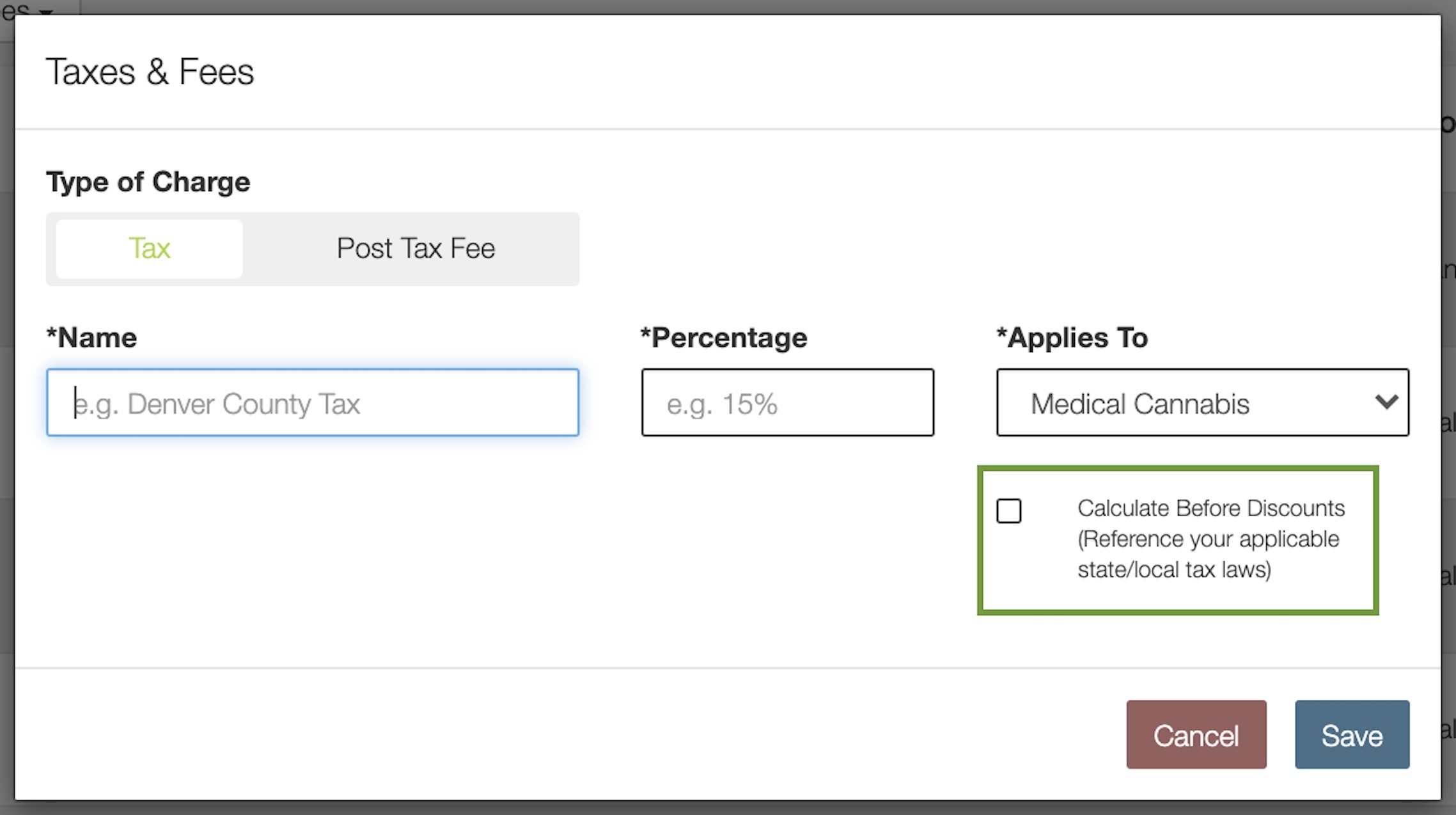

How To Calculate Cannabis Taxes At Your Dispensary

Independent Houses Near Geethanjali High School Central Excise Layout Sanjaynagar Bengaluru 36 Houses For Sale Near Geethanjali High School Central Excise Layout Sanjaynagar Bengaluru

Excise Taxes Excise Tax Trends Tax Foundation

Autumn 07 Cover All World And Gb Buy Bid Catalogue

Sales Tax Calculator And Rate Lookup Tool Avalara

Excise Taxes Excise Tax Trends Tax Foundation